Answer: CMHC (Canada Mortgage and HousingCorporation) insurance is a mandatory insurance for homebuyers in Canada who make a down payment of less than 20% of the purchase price of the home. It protects lenders in case a homeowner defaults on their mortgage.

Answer: If your down payment is less than 20% ofthe home’s purchase price, you’ll need to pay for CMHC insurance. The Mortgage CMHC Calculator helps you determine the exact amount of the premium, allowing you to account for this additional cost in your home purchase budget.

The premium is a percentage of the loan amount (purchase price minus down payment). The percentage depends on the size of your down payment, with a smaller down payment resulting in a higher premium rate.

Yes, while you have the option to pay the CMHC insurance premium upfront, most homebuyers choose to add it to their mortgage amount

Yes, if you’re purchasing an additional property and the down payment is less than 20%, you’ll still need to pay for CMHC insurance, regardless of how many properties you own.

The only way to avoid paying CMHC insurance is by making a down payment of 20% or more on your home purchase.

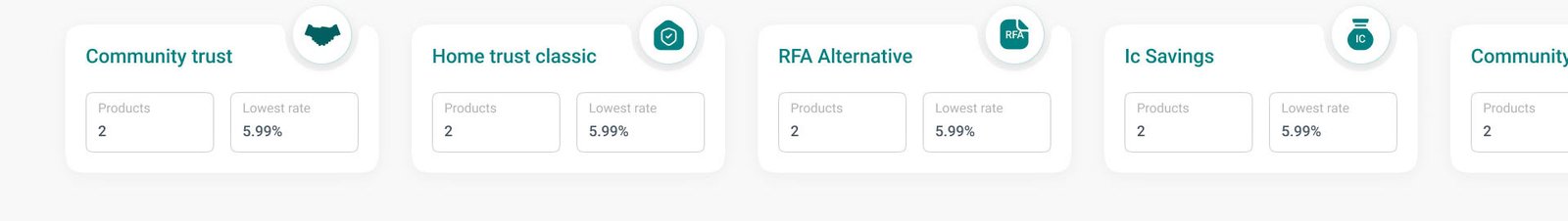

Yes, while CMHC is the most well-known mortgage insurance providers in Canada, there are private insurers like Genworth Financial and Canada Guaranty that also offer mortgage default insurance

The CMHC premium is a one-time fee. However, if you choose to add the premium to your mortgage, you’ll be paying interest on that amount for the duration of your mortgage

No, the CMHC premium percentages are consistent across Canada. However, some provinces have additional sales taxes that apply to the premium.

If you increase the amount of your mortgage during a refinance and the total loan-to-value ratio is above 80%, you might need to pay an additional CMHC premium on the increased amount.

Answer: CMHC (Canada Mortgage and HousingCorporation) insurance is a mandatory insurance for homebuyers in Canada who make a down payment of less than 20% of the purchase price of the home. It protects lenders in case a homeowner defaults on their mortgage.

Answer: If your down payment is less than 20% ofthe home’s purchase price, you’ll need to pay for CMHC insurance. The Mortgage CMHC Calculator helps you determine the exact amount of the premium, allowing you to account for this additional cost in your home purchase budget.

The premium is a percentage of the loan amount (purchase price minus down payment). The percentage depends on the size of your down payment, with a smaller down payment resulting in a higher premium rate.

Yes, while you have the option to pay the CMHC insurance premium upfront, most homebuyers choose to add it to their mortgage amount

Yes, if you’re purchasing an additional property and the down payment is less than 20%, you’ll still need to pay for CMHC insurance, regardless of how many properties you own.

The only way to avoid paying CMHC insurance is by making a down payment of 20% or more on your home purchase.

Yes, while CMHC is the most well-known mortgage insurance providers in Canada, there are private insurers like Genworth Financial and Canada Guaranty that also offer mortgage default insurance

The CMHC premium is a one-time fee. However, if you choose to add the premium to your mortgage, you’ll be paying interest on that amount for the duration of your mortgage

No, the CMHC premium percentages are consistent across Canada. However, some provinces have additional sales taxes that apply to the premium.

If you increase the amount of your mortgage during a refinance and the total loan-to-value ratio is above 80%, you might need to pay an additional CMHC premium on the increased amount.

Praise Pour In : Clients Share Their Delightful Experiences and Stellar Recommendations

We are dedicated to bringing smile to your face

We are constantly striving to achieve excellence

A Team of experienced professionals you can trust

anil@shelto.ca

647-649-3901

6733 Mississauga Road, Suite 700 , Mississauga , ON-L5N 6J5

WhatsApp me